Six New Year's Resolutions For Home Buyers

Whether you’re tired of paying rent instead of building equity in a home you can call your own, yearning for a patch of grass where your kids or dog can run free, or simply wanting to be able to paint your walls whatever color you want, longing for a house of your own is a powerful motivator that may be spurring your New Year’s Resolutions this year.

But before you get caught up in house fever, you’ll need to do the hard work of getting your finances in order so your homeownership dreams can come true. In this blog post, Maleno outlines six ways to get ready to purchase your first house.

1) Perform a Financial Checkup

How much do you want to spend?

One of the first questions a real estate agent will ask you: How much do you want to spend on a house? A general rule of thumb is to spend no more than 28 percent of your monthly household income on your monthly mortgage payment. In this calculation, include property taxes and homeowner’s insurance to create your total monthly payment picture. Of course, you may not want to spend up to your limit to free up money each month for other priorities, but this is a threshold you'll want to avoid crossing.

Next, know that mortgages aren’t one-size-fits-all. Seeking guidance from a mortgage lender will help you ascertain what type of mortgage will best suit your needs.

Then, you’ll want to consider how much you want to have ready as a down payment. Putting 20 percent down will eliminate the need for costly private mortgage insurance. What’s more, it generally also nets you a better interest rate.

But if you don’t have 20 percent to put down, it’s not the end of your prospective homeownership road. You may opt to continue saving, or you can still explore other loan options, such as a Federal Housing Administration (FHA) loan. Talk to a mortgage lender to learn more about the right mortgage for you.

What is your credit score?

Another number you’ll need to nail down before you go house hunting: Your FICO score. Credit scores range from 300 to 850. The higher your FICO score, the less you’ll pay in mortgage interest each month, typically. Lenders use FICO scores to calculate the likelihood of you paying your mortgage in full and on time. If they determine you’re a poor credit risk, they may charge you more for the loan or decline to offer you a mortgage altogether.

According to Experian, the average FICO score in the United States is 701. Here is a breakdown of FICO scores:

- Exceptional 800-850

- Very Good 740-799

- Good 670-739

- Fair 580-669

- Very Poor 300-579

You’re entitled to a free credit report every year from each of the three main credit bureaus: Experian, Equifax, and TransUnion. Check out AnnualCreditReport.com for more information.

To learn more about how much you can afford to spend on a house and how your FICO score affects the mortgage interest rate you’ll pay, check out this Forbes Home Affordability Calculator.

2) Get a Handle on Debt

2) Get a Handle on Debt

While it may be tempting to finance a shiny new car to park in your soon-to-be new driveway, first consider the impact of new debt on your debt-to-income ratio. The more debt you have, the less house you’ll be able to afford. Mortgage lenders will take a close look at how much other debt you already have, such as:

- Student loans

- Car loans

- Credit card debt

- Other consumer debt

To find your debt-to-income ratio, add up all your monthly debt obligations, and divide the total by your gross monthly income (your paycheck before taxes). According to the Consumer Financial Protection Bureau, lenders cap borrowers at 43 percent of total debt.

Consider how tight that debt-to-income ratio might feel, however, and determine if that large of a mortgage payment might curtail other goals such as retirement savings, vacation spending, or college savings for children. You may need or want to whittle down debt before applying for a mortgage loan.

3) Create a Budget

Once you’ve set a goal to save for a down payment on a house or knock out debt, consider creating a spending plan to prioritize spending. Although a budget can feel restrictive, think of it as a blueprint for achieving your homeownership goals. The more you save each month, the faster you’ll have the cash in hand to purchase a house.

Some people use an Excel spreadsheet to track spending, while others simply write down monthly targets in a notebook. If you struggle with overspending in a particular area, such as eating out, for example, consider setting aside a certain amount of cash in an envelope each month towards that line item. Once it’s gone for the month, it’s gone, and you won’t spend more than you intended.

4) Lower Monthly Expenses

4) Lower Monthly Expenses

After you’ve created a budget, you may want to trim expenses to boost savings. Consider making temporary sacrifices to achieve homeownership more quickly. While author David Bach famously made the case that small, daily expenditures, such as lattes, can cost us thousands over a span of years, there are other ways to be more mindful of spending. Consider:

- Adding a roommate to lower rent costs or moving to a less expensive apartment

- Shopping grocery store circulars for loss leaders (products that are sold at such low prices the store actually loses money)

- Creating a meal plan around inexpensive but healthy foods (for inspiration, check out Budget Bytes)

- Removing your credit card from online shopping sites to cut down on impulse purchases.

- Slashing discretionary monthly expenses such as cable, unused gym memberships, or magazine subscriptions

- Minimizing your nights out at bars and restaurants

5) Look for Ways to Boost Income

In addition to trimming the fat from your budget, you may also need to increase what you bring home each month. If you’re in a position to do so, consider negotiating a raise at work. Other ideas include:

- Selling used items online

- Picking up over time

- Adding a side hustle such as rideshare driving, freelancing, dog walking, babysitting, or tutoring

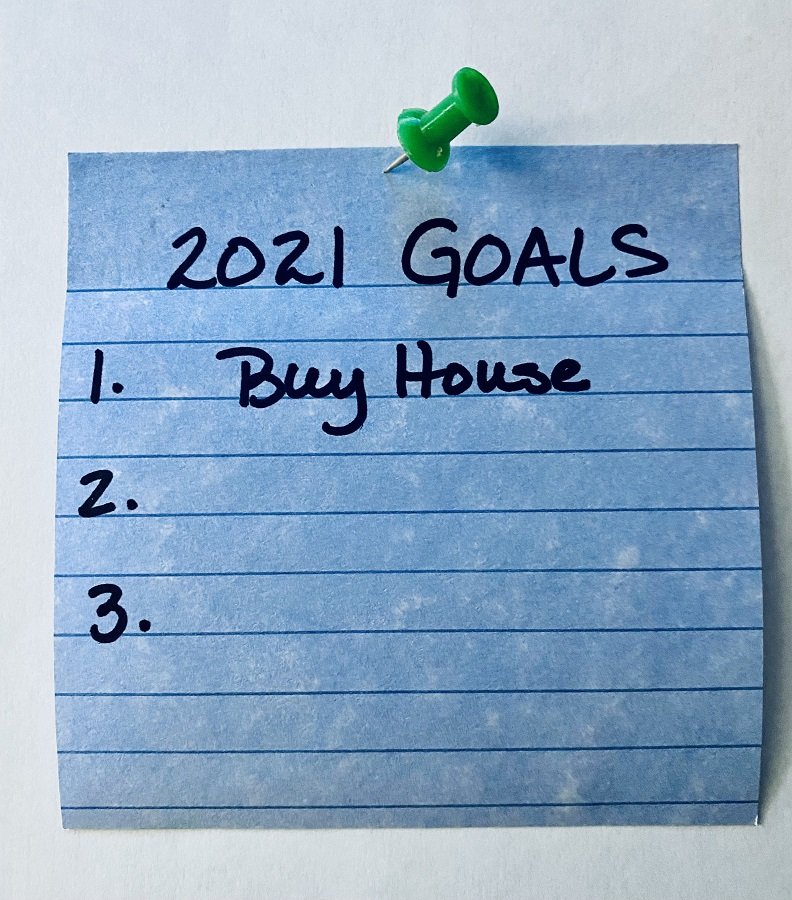

6) Visualize Your Goals

It sounds corny, but it may inspire you: Consider creating a visual reminder of how much you need to save to make your homeownership dreams come true. Post it in a conspicuous place, such as your kitchen refrigerator, so you’re reminded daily of why you’re saving diligently or slashing debt. As a bonus, your friends and family will see the goal as well and can cheer you on. At the very least, they’ll understand why you’re brown bagging your lunch every day.

Let Us Help You Find the Perfect House

New Year’s resolutions come in all shapes and sizes. If you’re determined to make this the year you become a homeowner, contact Maleno today to find out how our seasoned real estate professionals can guide you through the process of buying your first home.

Contributed by Matt Flowers

Contact Us for More Information