How to Leverage Real Estate Debt Like a Pro

Debt: the financial situation that four in five Americans currently find themselves in. Whether their debt comes from credit cards and mortgages or student loans and medical bills, Uncle Sam’s residents are seriously in the red. However, not everyone with debt is in a financially precarious situation. In fact, many of the most experienced investors know how to use debt to their advantage.

If you’re looking for a way to invest without emptying your savings account, you’re reading the right blog. In this piece, we’ll break down how you can leverage real estate debt, or simply “use leverage” to realize significant returns.

Give Me Leverage...and I'll Move the World

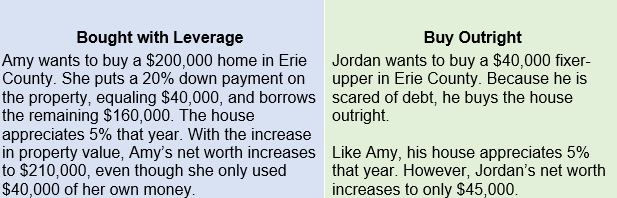

Before exploring how to invest in real estate using leverage, let's lay out the road map by explaining exactly what "leverage" is. Put simply: to "use leverage" is to borrow capital to increase the potential returns of an investment. When it comes to investing in real estate, the most common method of leverage is through one's own assets and a mortgage. To add clarity to this idea, let's compare two examples:

By using leverage, Amy sees a 400% increase in net worth. By buying his property outright, Jordan only realized a 12.5% increase.

It is critical to understand that leverage is a double-edged sword. Should the property examples above have depreciated 5% in the first year, Amy’s net worth would have dropped to $190,000 and Jordan’s to $42,250. Should this depreciation pattern continue for five years, Amy would lose roughly $45,000, whereas Jordan would only lose about $9,000. To make matters worse, Amy would still have to make payments on a $160,000 mortgage even though her house would only be worth $155,000.

However, if you make smart, well-informed investment decisions, you can mitigate the likelihood of purchasing a property that depreciates in value. To do so, be sure to find a real estate agent who knows the market and can reasonably predict where it’s headed.

Leveraging the Value of Your Home

In contrast to a home equity loan, a HELOC acts more like a credit card, allowing you to access cash when you need it. Whenever you're using a HELOC for leverage, be sure to look at the introductory rates. Many of them have incredibly low rates that range between 3.00% and 5.00%. So as to best capitalize on the low-interest introductory period, we recommend that this method of leverage be used for short-term investments.

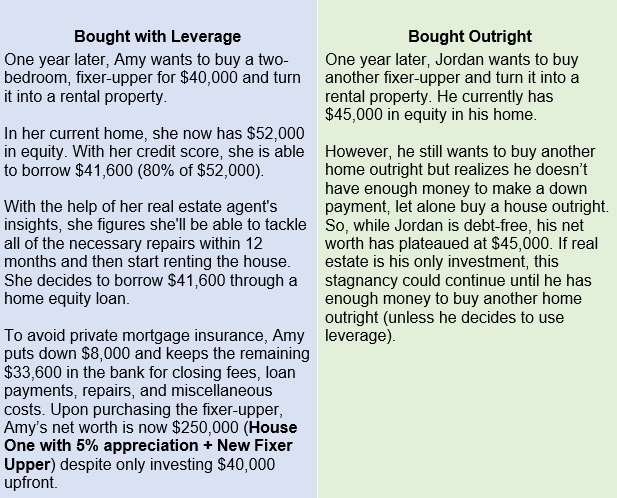

Depending on your credit score and debt-to-income ratio, you can typically borrow between 75%-90% of your equity in the home. To get a clearer idea of how leverage can open the door of opportunity, let's check back with our previous examples.

Who is Really Ahead?

At this point, those with a critical eye for finance may be asking themselves, what about the interest Amy is paying for her loans? Also, is she really any further ahead than Jordan? The answer depends on several core indicators:

- Interest Rate

- Term of Loan

- Extra Payments Made

Let's say Amy's original $160,000 fixed-rate loan had a 5.00% interest rate and a 15-year term. She's also adamant about paying less interest, so she makes an extra $1,000 payment each year (saving $6k in interest over 15 years). Ultimately, Amy will pay about $61,000 over the term of her loan.

In conjunction with her mortgage, she has a $41,600 home equity loan (5/1 adjustable-rate mortgage (ARM) at 3.5%). With no additional payments, she'll pay about $7,000 interest.

However, amid these payments, she's created a passive income stream through her investment property. If over the term of her home equity loan, Amy is consistently charging a modest $800 per month for her two-bedroom, she'll gross $48,000, which would just about pay off the loan.

What's more, the interest that's accrued from these loans are tax-deductible, meaning over the course of 15 years, Amy will be able to write off nearly $70,000 in interest. At the end of the day, Amy's ability to leverage debt positions her to:

- Diversify her portfolio

- Have a significantly higher net worth

- Live in a better home

- Generate a passive income stream

- Create multiple sources of equity

It's the last one on the list that serious investors utilize. By expanding their portfolio, they're able to tap multiple properties for home equity loans and lines of credit. In a hot market, cash flow is an invaluable asset for buyers.

Maleno Real Estate

Whether you're looking for a beautiful place to live or searching for your next investment property, reach out to Maleno today. With niche neighborhood knowledge, in-depth market insights, and concierge-level service, we'll find a home that's right for you.

Contributed by Matt Flowers